7 RollWorks Alternatives You Should Consider

RollWorks is a solid entry-level option for teams dipping their toes into ABM. It’s easy to set up, relatively affordable, and gets you part of the way there.

But for many revenue teams, “part of the way” isn’t enough.

When your pipeline depends on influencing real people—not vague accounts—you need more precision, control, and transparency than RollWorks can offer. You need to know exactly who you're targeting, who’s engaging, and how your campaigns are influencing revenue.

If you’ve hit the ceiling with RollWorks—or you're evaluating your options before investing—this guide walks through seven alternatives worth exploring.

Each one offers a different advantage:

- More advanced targeting

- Deeper CRM and MAP integrations

- Smarter intent signals

- Better alignment between Sales and Marketing

Let’s start with the one that flips the whole model on its head.

1. Influ2

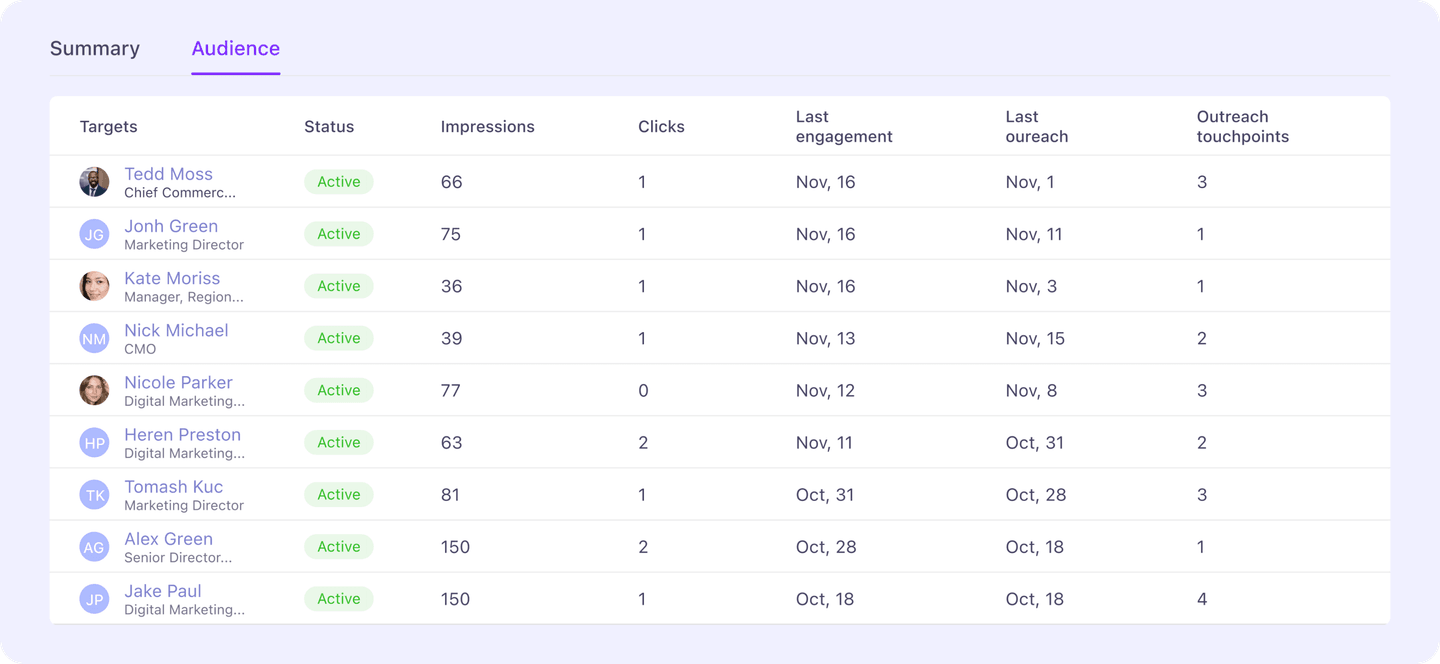

Influ2 is a contact-level ABM engine. With Influ2, revenue teams can:

- Spot the moment named buyers focus on topics that matter to them.

- Target buyers with ads where they spend their time and exactly who you reached by name.

- Guide each buyer with messages matched to their intent, engagement, and sales stage.

- See in number how each engagement lifts sales conversion rates and turns into revenue.

Here's why teams choose Influ2 over RollWorks:

Get contact-level intent signals

Influ2 lets you see who's researching topics that matter to your business and what they're interested in across social, search, ads, and third-party content. Sync contact lists from your CRM and Influ2 monitors signals from those specific buyers.

Check out this page to learn more about how Influ2's contact-level intent works.

Show ads across more channels

RollWorks has a decent ad offering for display and native advertising, but it doesn’t tick a lot of boxes when it comes to running ads on social, giving you limited reach within the broader buying journey.

Influ2 lets you run contact-level ads across LinkedIn, Instagram, Facebook, Google, Bing, Taboola, and Amazon.

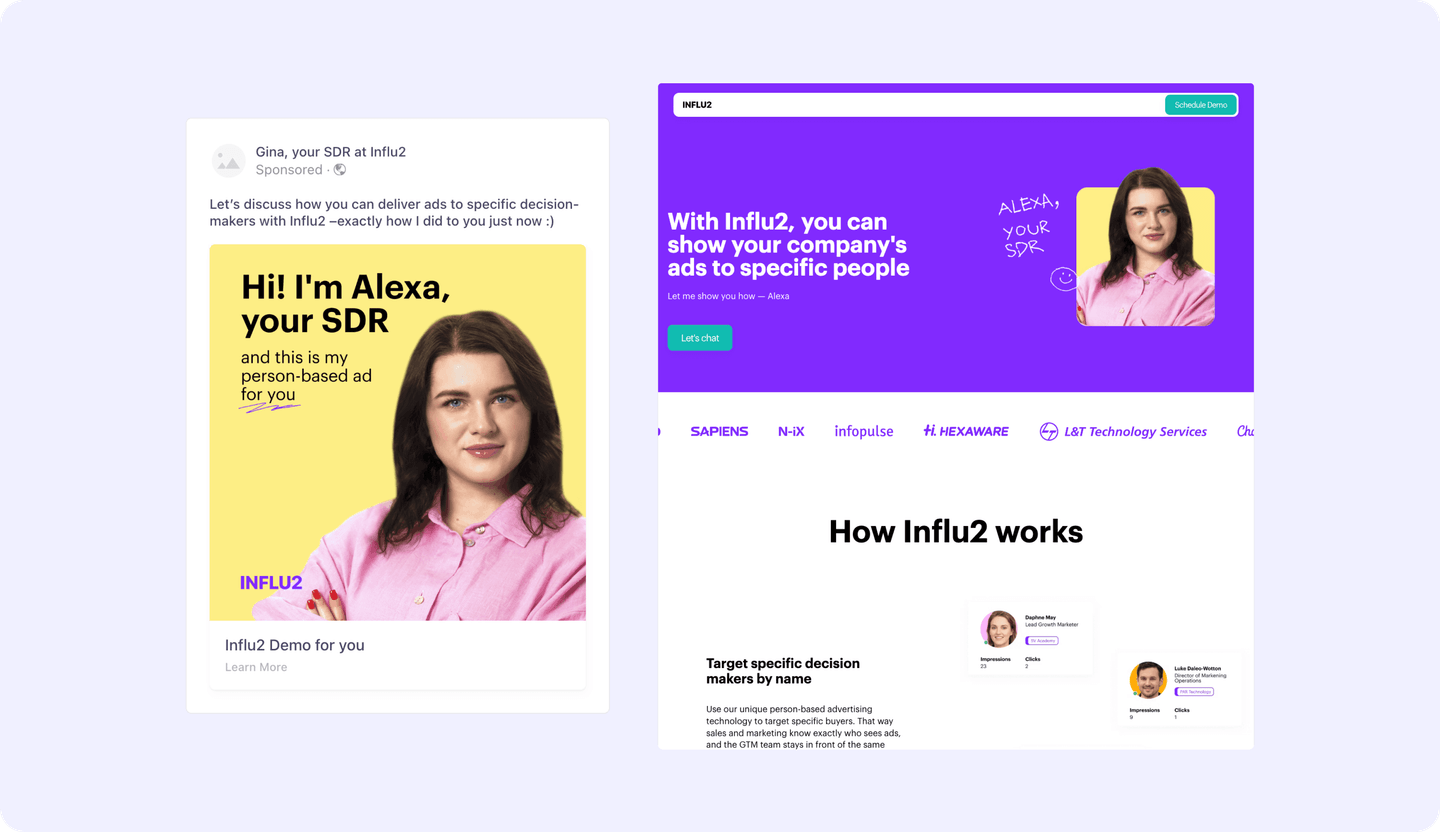

Target exact buying group members with relevant ads

With RollWorks, you can mostly target at the account level, with some ability to narrow down based on job function or seniority. You can’t specify the exact people to whom you show ads, meaning you can’t guarantee that people with actual decision-making power will be the ones you reach.

With Influ2, you upload a list of named buyers and show ads to each individual prospect that are relevant to their persona and stage in the buying journey.

With this approach, you’re ensuring that your ads reach the same people your reps are going after with the same messaging Sales is using.

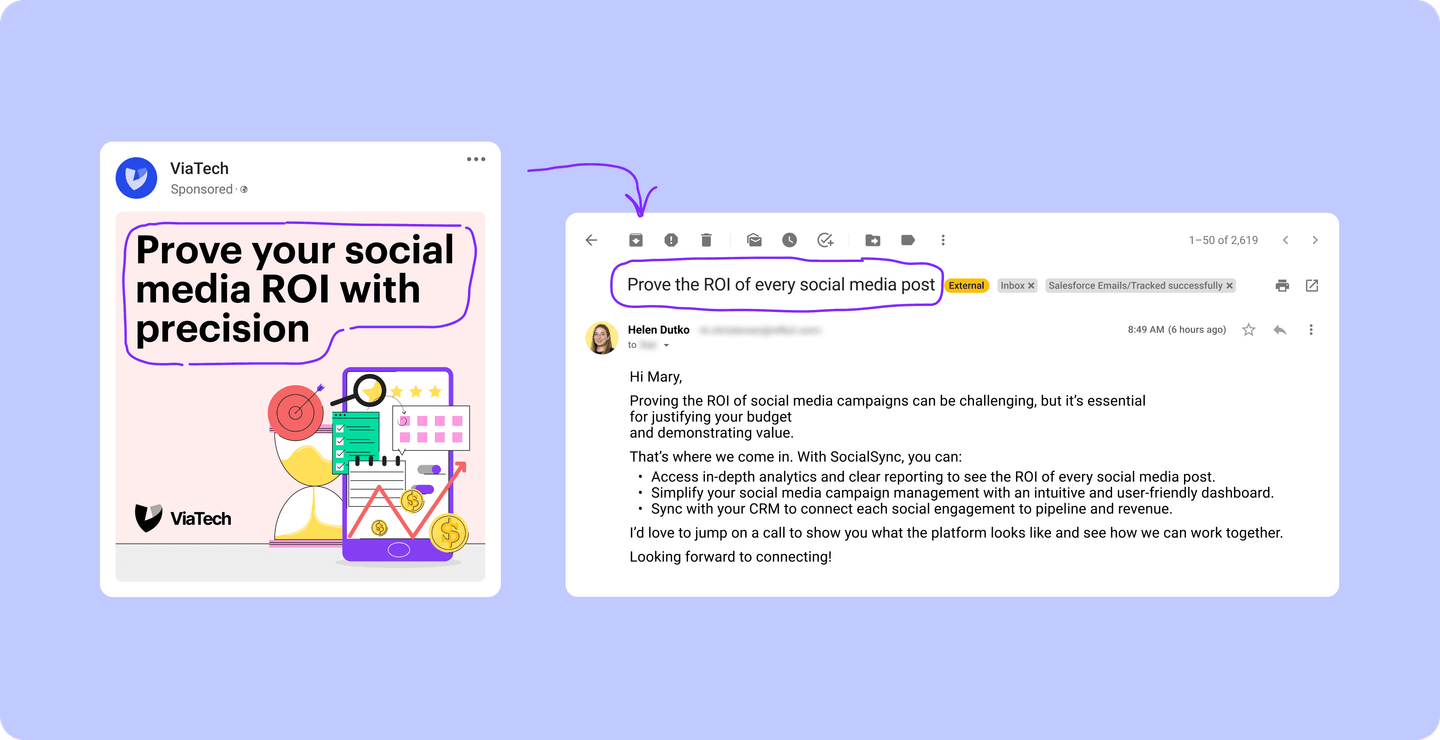

Align sales outreach with ad programs

The contact-level intent signals your ads generate go straight to your CRM, so reps have context where they need it and can align their email outreach with demonstrated intent.

Marketing can also further support SDR outreach by putting a face to the name and influence meeting attendance rates with ads you show only to people scheduled to be on the demo.

You can’t do that with RollWorks or any of the other alternatives on this list—you’d have to run the AE ad to the entire account.

2. 6sense

6sense and other ABM platforms like Demandbase, RollWorks, and ZoomInfo share a lot of similar features. In a lot of cases, they are near interchangeable.

But 6sense’s edge is its use of predictive analytics and artificial intelligence to suggest to revenue teams which accounts they should go after. This integrates buyer behavior across third-party sites (e.g., on G2) and interactions with your own brand, where present, to help sales teams prioritize their workloads.

Key features:

- Demand-side platform (DSP): 6sense has a built-in DSP (an interface for buying and managing ad inventory) for B2B advertising.

- Intent data: 6sense integrates third-party intent data from publisher networks, Bombora, and G2, which is used for intel for its predictive modeling.

- AI workflows: You can use 6sense’s AI engine to write sales outreach emails and automatically adjust ad audiences based on performance and intent signals.

- Company and contact data: 6sense has a B2B buyer database with phone numbers, emails, and firmographic data like industry and revenue to help you find accounts that fit your ICP.

Some users note that 6sense is more expensive than RollWorks, but has a stronger and easier-to-interpret intent data model.

See what users are saying about 6sense on G2.

3. Demandbase

Demandbase is a classic ABM alternative to RollWorks.

People choose it over RollWorks often when they make the move up to targeting enterprise companies. RollWorks’s data tends to focus more on SMBs and mid-market companies, where Demandbase has a lot more firmographic and technographic intel on enterprise-level companies.

Key features:

- Company data: Demandbase’s data tells you what other software tools target accounts are using, how many employees the company has, and what child/parent relationships they have to other companies (important for territory and account planning).

- Intent data: Demandbase offers third-party intent data from Bombora as well as its own proprietary network.

- Built-in DSP: You can advertise at the account-level on display, social (LinkedIn and Meta), and Connected TV.

- Website personalization: You can build dynamic landing pages where copy and creative changes based on the viewer’s industry, company, or persona.

See what users are saying about Demandbase on G2.

4. Metadata.io

Metadata.io is a B2B advertising platform.

Where RollWorks tackles account-based marketing as a whole (albeit with a heavy ad leaning), Metadata.io focuses specifically on optimizing paid campaigns, using AI-driven experiments as the catalyst.

Many teams use Metadata.io in conjunction with a platform with wider capabilities, like Demandbase or 6sense, since Metadata.io itself doesn’t have intent data and isn’t built to help teams identify target accounts.

Key features:

- Audience targeting: You can import CRM and MAP data, use firmographic and technographic filters, or rely on behavioral and engagement signals to build ad audiences.

- Experimentation and optimization: Metadata.io has a strong AI experimentation engine that can test thousands of ad combinations and allocate budget to the top-performing options.

- Managed services: You can pay the team at Metadata.io to run your entire ad campaign if you don’t have internal resources or capabilities.

- Lead enrichment: While Metadata.io doesn’t provide intent data, it does have a standard company and contact data offering, which can be used to enrich incoming leads that you generate with your ad programs.

See what users are saying about Metadata.io on G2.

5. ZoomInfo

ZoomInfo is another “everything in one box” ABM platform. It started out as a B2B data supplier (and that’s still one of its main strengths), and slowly built out or added functionality through acquisitions to become what ZoomInfo describes as a “GTM intelligence platform”.

Key features:

- Sales intelligence and data: ZoomInfo has B2B company and contact data, firmographic and technographic intelligence, intent data (from Bombora), buying signals (e.g., funding announcements and job change alerts), and tracks engagement with your company website and emails.

- GTM orchestration: You can automate sales and marketing workflows (like email outreach or ad sequences) based on account behavior and buying signals, and integrate with tools like Salesforce, HubSpot, Outreach, Salesloft, and Marketo.

- Conversation intelligence: ZoomInfo also has a tool that’s quite similar to Gong (call Chorus) that tracks sales conversations (like phone calls and emails) and uses AI to identify winning patterns, such as word tracks or pain points to touch on.

See what users are saying about ZoomInfo on G2.

6. StackAdapt

StackAdapt, much like RollWorks, is a company that got its start as an advertising platform, then gradually expanded its offering to cover the entire customer journey of marketing touchpoints (e.g., abandoned cart emails automation).

Its biggest strength is its cross-channel ad capabilities. StackAdapt can run ads across native, display, video, connected TV (CTV), audio, in-game, and digital out-of-home (DOOH).

Key features:

- Cross-channel advertising: You can run ads on a wide range of channels, with the big exception of social media. But native, video, display ads, and more are available.

- Audience targeting: You can import your own first-party data to build audiences or target using geo-targeting, remarketing, or account-based targeting.

- Email marketing: StackAdapt has a built-in HTML editor and email automation tool, so you can trigger email campaigns based on ad clicks or set up multi-channel remarketing.

- Dynamic ad creative: You can set up ad programs where the creative a prospect sees changes based on attributes such as preferences or behaviors.

- Creative studio: StackAdapt also has a “done for you” advertising development service, including storyboarding, scripting, and motion design.

See what users are saying about StackAdapt on G2.

7. N.Rich

N.Rich is an ABM advertising platform. It helps revenue teams run programmatic ad campaigns, using a combination of first and third-party data to change ad creative based on funnel stage or trigger ads based on prospect behavior.

Compared to RollWorks, N.Rich’s biggest strength is its attribution, which is more granular and transparent than RollWorks’s aggregated model. However, N.Rich only offers advertising via native and display, missing out on the social media channel.

Key features:

- Customer journeys: You can trigger downstream workflows, like sales alerts or email campaigns, to kick off based on ad engagement signals.

- ICP creation: N.Rich has an ICP builder that helps sales teams define their ICP based on metrics like sales cycle length and win rate.

- Creative personalization: N.Rich allows for a high degree of ad creative personalization. You can build dynamic programs where what prospects see changes as they move through the buying journey.

- Account-based ad targeting: N.Rich offers IP, cookie, and device-based ad targeting.

See what users are saying about N.Rich on G2.

Dominique Jackson is a Content Marketer Manager at Influ2. Over the past 10 years, he has worked with startups and enterprise B2B SaaS companies to boost pipeline and revenue through strategic content initiatives.