Stop Misreading the Signals: What Buyers Are Really Telling You

Say someone at a target account searches your brand name, clicks an ad, or checks out a few of your competitors on G2.

Are they ready to talk? Just browsing? Or quietly evaluating behind the scenes?

The short answer: It depends on the context of the signal and who it came from.

When you treat every signal the same, buyers can tell.

The days of “Dear {First name}, {generic pitch}” are gone. People’s inboxes are full, anyone can spin up mass emails with AI, and standing out is harder than ever.

Your differentiator needs to be relevance and showing you understand what your buyers need at this exact moment. Otherwise, you’re going keep sending thousands of emails to people at your target account and hoping someone replies.

The first step is understanding what different signals actually mean, so you can show up in context and get seen as helpful instead of an annoyance.

Here are 10 buyer signals worth tracking, plus guidance on what they mean, when to act, and how to do it without coming across like a chatbot.

First, account-level signals aren't enough

The foundation of any signal-based campaign is knowing who signals come from. This is hands down one of the biggest issues we notice with ABM programs.

Since most ABM platforms are built around accounts, their signals look like this: Someone from Adobe clicked your ad.

Handing that to a salesperson and saying “go get 'em” is like sending your partner to the grocery store with just a list of aisle numbers and being disappointed with what they bring back.

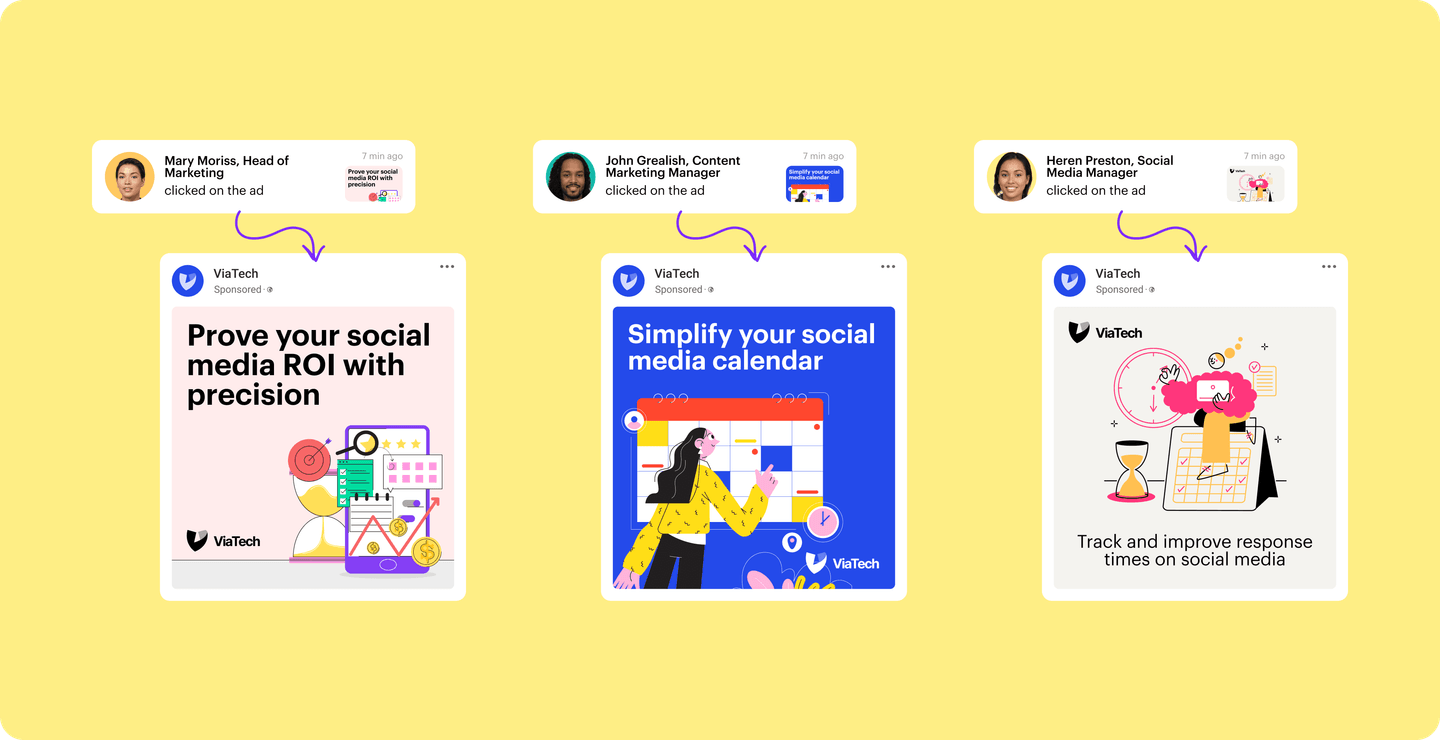

Instead, we're all about contact-level ABM. Where everything from who you target to the signals Marketing provides Sales are attached to named buyers. Those signals look more like this: Jane Wall from Adobe clicked your ad about Tracking Digital Marketing ROI.

That's exactly what Influ2 helps companies do. We provide signals you’re used to getting from other ABM platforms, but at the contact-level, including search intent, social intent, and content intent.

You can see how our contact-level intent signals work here.

Now, let’s get into how to interpret different buyer signals.

1. Ad engagement

When buyers click your ads, it tells you what your buyers are curious about, even if they’re not saying it out loud.

But to be truly useful, you need to know exactly who clicked the ad. And most tools can’t connect ad clicks to an actual person unless the person also happens to fill out a form (something the majority of buyers don’t do). Influ2 changes that.

You can show your ads to the exact people you want to reach—pulled straight from your CRM—then track their engagement (without form fills) to surface contact-level signals.

Each click is a signal about what matters to that individual right now.

For example, if someone clicks an ad about making intent actionable for SDRs but ignores one about boosting meeting attendance, that tells you pipeline generation might be their current pain point.

But not every click means they’re ready to buy. The value of an ad click depends on what they clicked, when they clicked, and what else they’ve done.

A click on an ad promoting an educational article suggests interest in the problem, not necessarily a sense of urgency to solve it.

A click on a mid- or bottom-of-funnel ad (like a value prop or case study) combined with visits to your pricing page? That’s a signal worth acting on quickly, before the context fades.

This is where context and EQ matter most:

- Context = What ad did they engage with? What other signals are you seeing from them?

- EQ = Based on that pattern, what kind of outreach would feel helpful, not pushy?

What matters most (and what Sales cares about) isn’t that a buyer clicked. It’s what the click means in context, and how you respond.

If the signals point to curiosity, meet it with education. If it shows clear product interest, that could be an opportunity to lean in with a more direct pitch.

Contact-level advertising is an extremely powerful strategy that’s made possible with Influ2. It’s the backbone of our ABM program, which we’ve used to influence millions in pipeline, and our customers are doing the same.

If you’re interested in turning ad engagement into actionable signals that can influence pipeline, let’s talk.

2. Search activity

Most buyer journeys begin with a search, but 60% end without a click. But knowing when your target buyers are searching for keywords you care about reveals what they’re thinking about before they engage with your brand directly.

That said, not all searches mean the same thing:

- Problem-aware searches (e.g., “how to increase email open rates”) suggest early-stage curiosity. The best response to these is to focus on the problem, rather than leading with your product.

- Category research (e.g., “best sales engagement tools”) is a stronger signal that the buyer is evaluating potential solutions.

- Competitor searches are a sign they’re exploring other brands in your category and might be in-market.

- Pricing or comparison searches (e.g., “Product A vs. Product B”) indicate they’re further along and potentially ready to engage.

One useful filter: how specific is the search? A vague query like “sales enablement” signals broad exploration, while a search like “Salesforce implementation time” points to someone actively weighing their options.

You can also break these signals down by function and seniority.

Individual contributors who may not have buying authority often search for how-to content. Senior buyers look for ROI comparisons, tech fit, or implementation details. Tailoring your message based on who is likely to have made the search can make follow-up more relevant.

This is why contact-level signals are so important. Knowing that someone at an account searched your brand name isn’t enough.

Influ2 offers true contact-level search intent. Meaning, you tell us who you want to get signals from, what topics/keywords are relevant to you, and we’ll let you know if and when those specific people search for those terms, even if they don't click through to your website.

3. Third-party content consumption

People don’t read articles about topics they don’t care about. So knowing that one of your target buyers, Jackie Wick, CMO at Acme, just read an article on Forbes about “Why CMOs are Betting Big on AI Search” would be super relevant to a company that sells AI search optimization software.

The problem is, for a long time, these signals stopped at the account level as well. So you’d know someone from Acme read an article, but not that it was Jackie.

We’ve changed that. Similar to how our search signals work, you tell us who your buyers are (we pull the contacts from lists in your CRM) and the topics you care about. Then we’ll track when those buyers are consuming content on third party sites about those topics, including the exact article they read.

This signal gives your sales team two key pieces of information:

- Timing: They can reach out when you know the topic is top of mind

- Context: They can create outreach that ties to the topic they were reading about, without directly mentioning the exact article (because that’s creepy)

4. Social listening

Social platforms are one of the few places where buyers publicly share what they’re thinking about—in their own words, in real time. Whether they’re posting about a challenge they’re facing, commenting on a trend, or engaging with competitor content, it’s all part of their digital body language.

But not every signal from social listening has to be product-related to be useful.

Even personal or professional updates, like a post about building a new team, sharing a tough lesson, or reacting to industry news, can give Sales helpful context. They offer a window into the buyer’s mindset, tone, and priorities. That’s what makes outreach feel human instead of scripted.

“Congrats on the new role” feels robotic.

“Saw you’re building out your GTM team—curious how you’re thinking about outbound right now” feels intentional.

Social listening helps you spot:

- Signals of shifting priorities or new initiatives

- Posts showing frustration or unmet needs

- Sentiment toward vendors or solutions

- Career changes that could influence buying behavior

- Opportunities to build rapport through shared interests or challenges

Manually keeping up with all of this across multiple accounts and buying committees is a full-time job, which is why teams aren’t able to do it at scale.

But Influ2 makes it possible. We surface relevant social media posts from your targeted buyers and filter out the noise.

The goal of social listening isn’t to monitor, it’s to understand. When Sales shows they’ve actually paid attention to what a buyer shares, the outreach doesn’t just feel timely; it also feels genuine.

5. Job changes

Job changes are one of the clearest signs that something has shifted in your buyer’s world. Whether it’s a new leader stepping in or a past champion starting fresh elsewhere, it’s a reset moment—and an opportunity to re-engage with context.

There are a few types of job change signals to watch for, each giving different insights into potential intent:

- New leadership: When new execs come in, they often bring new tools, new processes, and a willingness to question the status quo. This is your window to position your solution as part of their vision.

- Team growth: Hiring sprees or role expansion suggest the company is scaling. That often means budget, shifting priorities, or new tech needs, especially if the roles align with your use case.

- Hiring announcements: Job openings are a growth signal as well, but this is particularly important if the openings are in your industry, as it tells you they’re actively investing in the particular function your tool serves.

- A past champion moves: One of the most actionable signals. If someone who already knows and loves your product lands at a new company, they can be your inside track. (Hint: You can track this with Influ2!)

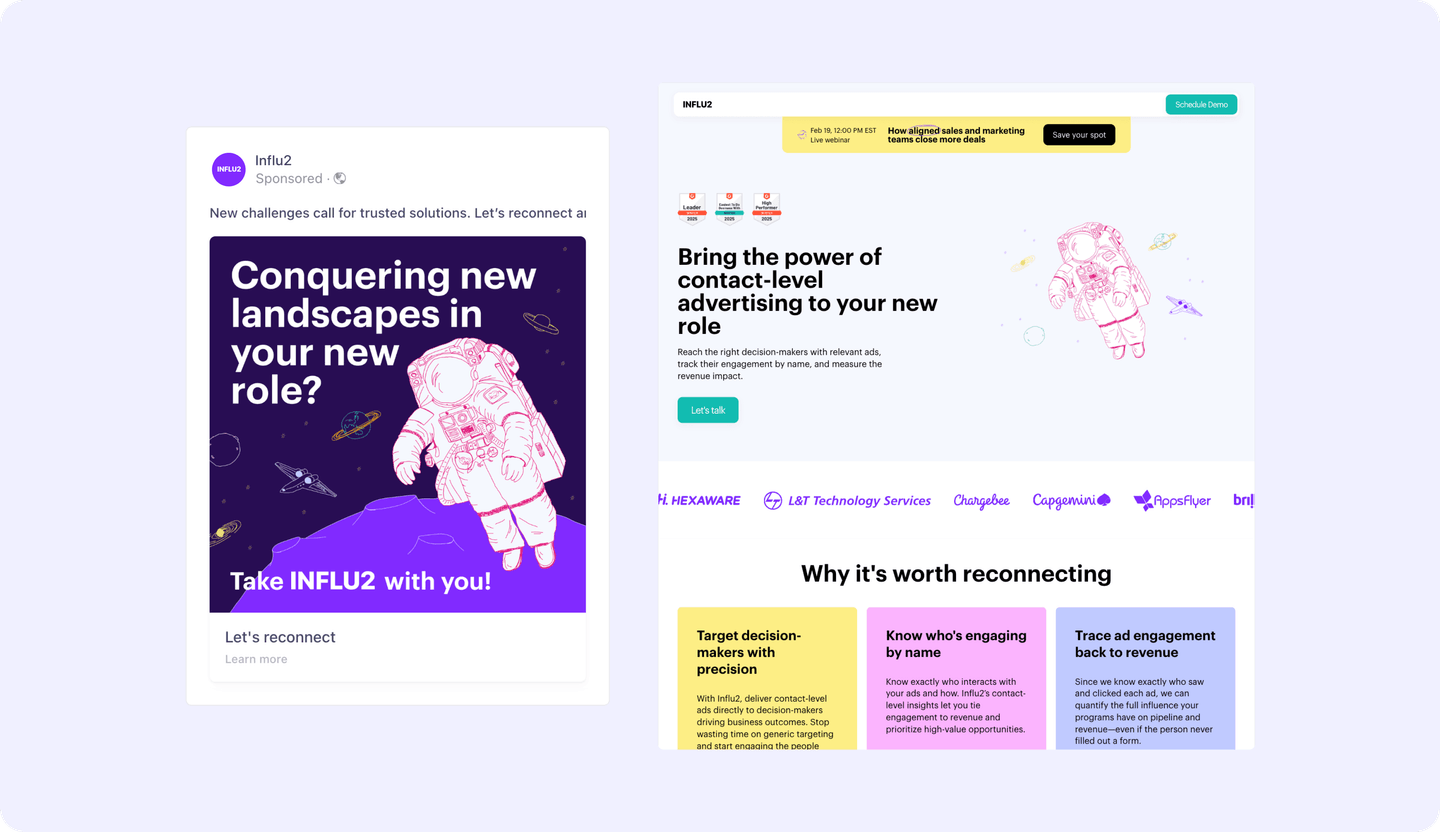

When a past user or buyer changes jobs, don’t just drop them into generic nurture. Add them to a dedicated ABM campaign that mirrors their new context. Serve them relevant contact-level ads, and have Sales reach out with a “welcome back” message that connects their past success to their new opportunity.

Here’s an example of a campaign we’ve run for past champions.

A job change doesn’t happen in isolation. It’s a shift in priorities, a potential budget unlock, and often a sign that change is coming. But it’s not always a green light to pitch.

The most effective teams use it as a signal to observe, understand the new context, and respond with EQ when the timing feels right.

6. Website behavior

Website visitor deanonymization software can help surface signals from people who haven’t raised their hands, but are still showing interest.

While this software can’t reveal every single visitor (usually it can tell you what company they’re from, but not always which specific person within it), you can still use it to track signals like:

- Which pages they visit

- How long they spend on a page

- How many times they return to a given page

- Focus on visitors who land on high-intent pages like pricing or integrations.

- Enrich visitor profiles with detailed context, tracking what they viewed, how often they visited, and relevant role or contact info.

- Trigger instant Slack notifications when priority contacts from owned accounts interact with key site pages, so SDRs can move quickly.

- Auto-segment contacts into lists using filters like job title, on-site behavior, and CRM ownership.

- Score and rank contacts based on engagement patterns, such as volume of visits or company size, to surface top prospects.

- Aim to follow up within 15 minutes of a high-intent visit to stay relevant and top-of-mind.

- Push qualified contacts straight into relevant, prebuilt email sequences inside Outreach.

- Use AI to auto-personalize outbound snippets using firmographic and behavioral data.

Don’t lean on website activity tracking in your outreach. It’s a touchy subject for some buyers and may turn them off. Instead, think of web signals as a way to spotlight and prioritize prospects. It’s up to you to build a compelling reason—ideally based on prospect and account research—to reach out.

7. Event engagement

Attending a webinar or showing up to an in-person dinner is a signal. But like all signals, it’s more actionable when you interpret it holistically.

Consider ZoomInfo’s event calendar.

Someone showing up to the ZoomInfo x Google Cloud dinner might be an interested buyer, but there’s an equal chance that they’re just there to network. The event itself just isn’t specific enough.

However, a buyer registering for the online event “Transforming Marketing Growth with the Power of Data” shows very specific intent. They are signaling that:

- Marketing growth is important to them.

- They’re exploring how data can drive that growth.

That insight can inform how both Marketing and Sales respond. Here are a few ways ZoomInfo could use varying degrees of intent to trigger different playbooks:

- Event interest: Anyone who clicks on the event page, but doesn’t sign up, receives a personalized email invitation.

- Registration but no-show: Those who register for the event but don’t show up, receive an email with the event recording and a LinkedIn InMail with a summary from the SDR.

- Attends event: Prospects who come to the event receive a personalized thank-you email from the SDR and an invitation to explore how ZoomInfo’s data offering could support that specific prospect’s goals.

Timing matters here. Event signals fade fast, so following up while the content is still fresh can make all the difference.

Pro tip: Marketing can run contact-level ads to reinforce event messaging before and after the session. That way, when Sales reaches out, the prospect already recognizes your brand and your value proposition.

8. Review site activity

Review sites like G2 and Capterra offer a window into account-level buying behavior. When someone from a target company is reading reviews, they’re actively comparing options.

Unfortunately, most platforms won’t tell you the individual contact, just that someone from the account viewed a specific category or competitor. That anonymity is part of the challenge.

Still, it’s a clue that buying conversations may already be happening internally.

For example, if someone at a target account is reviewing Procurify on G2, Vendr could use that insight to:

- Prioritize the account for near-term outreach

- Focus their message on clear points of differentiation

- Create a resource like a competitor comparison or case study

- Loop in other signals (e.g. ad engagement, job title changes) to identify who to contact

Pro tip: Marketing can amplify this signal by launching contact-level ads or sending Sales enablement content (like a “Why customers switch from X to us” deck) to accounts showing competitor interest.

9. Funding announcement

Funding announcements get a lot of attention as buying signals, but they’re often misunderstood. Just because a company has new capital doesn’t mean they’re ready to buy your product.

What it does tell you is that the conditions around the buyer have changed. They may be hiring, expanding into new markets, or investing in infrastructure. It’s not a signal of intent, but it can be a useful filter when combined with others.

As Eric Nowoslawski, founder of Growth Engine X, notes, you can’t just look for companies that have raised new funding and use that as the basis for outreach. You need another compelling reason to reach out.

I don’t want to start every email with, ‘Hey, congrats on your latest funding round,’ because then you’re just the same as everybody else. So we’ll pick another relevant data point to bring up about the company, but use the funding round signal to build the overall list.

That’s the right mindset. Use funding as a way to prioritize accounts, not as the sole reason to reach out. Layer in other signals like ad engagement, case study views, or recent job postings to validate timing.

This one also depends a bit on your ICP.

If you sell FP&A software for growth-stage companies, a Series A might suggest budget readiness and a need for better planning tools. But if your product is typically adopted later in the maturity curve, this signal may be too early to act on.

Think of funding as part of the background noise in your buyer’s digital body language. It’s not a direct cue, but more of a change in the environment that could shape the conversation.

10. Technographic changes

Technographic data (what tools an account is adopting, replacing, or sunsetting) has traditionally been used to confirm ICP fit. But it can also signal change, dissatisfaction, or momentum.

If a company recently adopted a complementary tool, it could mean they’re building toward a broader strategy, and your product might complete the picture. That gives you an opening to frame your pitch around integration, efficiency, or adding more value to their stack.

On the flip side, if they’ve uninstalled a competitor, that’s a potential signal of churn or even frustration. Combine that insight with a negative G2 review or a LinkedIn comment, and you’ve got a compelling case for a high-context, empathetic outreach:

“Saw your team moved off Platform X recently. We often hear customers struggled with [common pain point]. If that’s true in your case, I’d be happy to share how others in [industry] made the switch.”

These signals may not scream buying intent, but they do whisper timing. And for teams who know how to connect the dots, that’s valuable.

Turn signals into smart, human outreach

In the past, ad clicks, job changes, and all the other signals we covered were treated as isolated activities that triggered outreach from Sales. But they’re more than activity, they’re digital body language.

When you interpret them in context and with empathy, you turn noise into insight and outreach into connection.

Influ2 helps you do exactly that with contact-level ABM. Get signals from named buyers, and give Sales the intel they need to follow up with relevance. We’ll show you how.

Dominique Jackson is a Content Marketer Manager at Influ2. Over the past 10 years, he has worked with startups and enterprise B2B SaaS companies to boost pipeline and revenue through strategic content initiatives.