What Bombora Intent Data Gets Right (And Where it Falls Short)

Your first goal within an ABM program is simple: figure out which accounts are most likely to be in the market for your product.

Bombora intent data does exactly that. It pools signals from across the web, compares them to industry-specific topic clusters, and delivers a ranked list of accounts showing the biggest “surges.”

In other words, it tells you where the action is happening.

But in a world of hyper-personalization and buyers with high expectations, knowing where isn’t good enough.

You need to know who.

For example, knowing Dunder Mifflin is in the market for your product is great—but until you know which stakeholders are digging into your solution, your outreach strategy is still basically guesswork.

Think of Bombora intent data as Step 1 in your process, lighting up the accounts you should prioritize.

We’re going to walk you through how Bombora intent data works, and introduce you to the Step 2 you didn’t know you needed.

Where Bombora’s intent data comes from and how it works

Bombora boasts a wide range of intent data from its B2B Intent Data Co-op, which anonymously tracks content consumption across a collection of 5,000 business websites. The traffic is categorized into more than 12,000 topic clusters, or groups of related subjects (e.g., “cloud security,” “account-based marketing,” etc.).

All of this research behavior is then pulled into their patented AI system, Company Surge, which flags when an account’s activity in any clusters spikes above their baseline.

The goal—prioritize accounts where multiple people are showing interest in your category.

How ABM teams fit Bombora into the workflow (and where their intent data could use a boost)

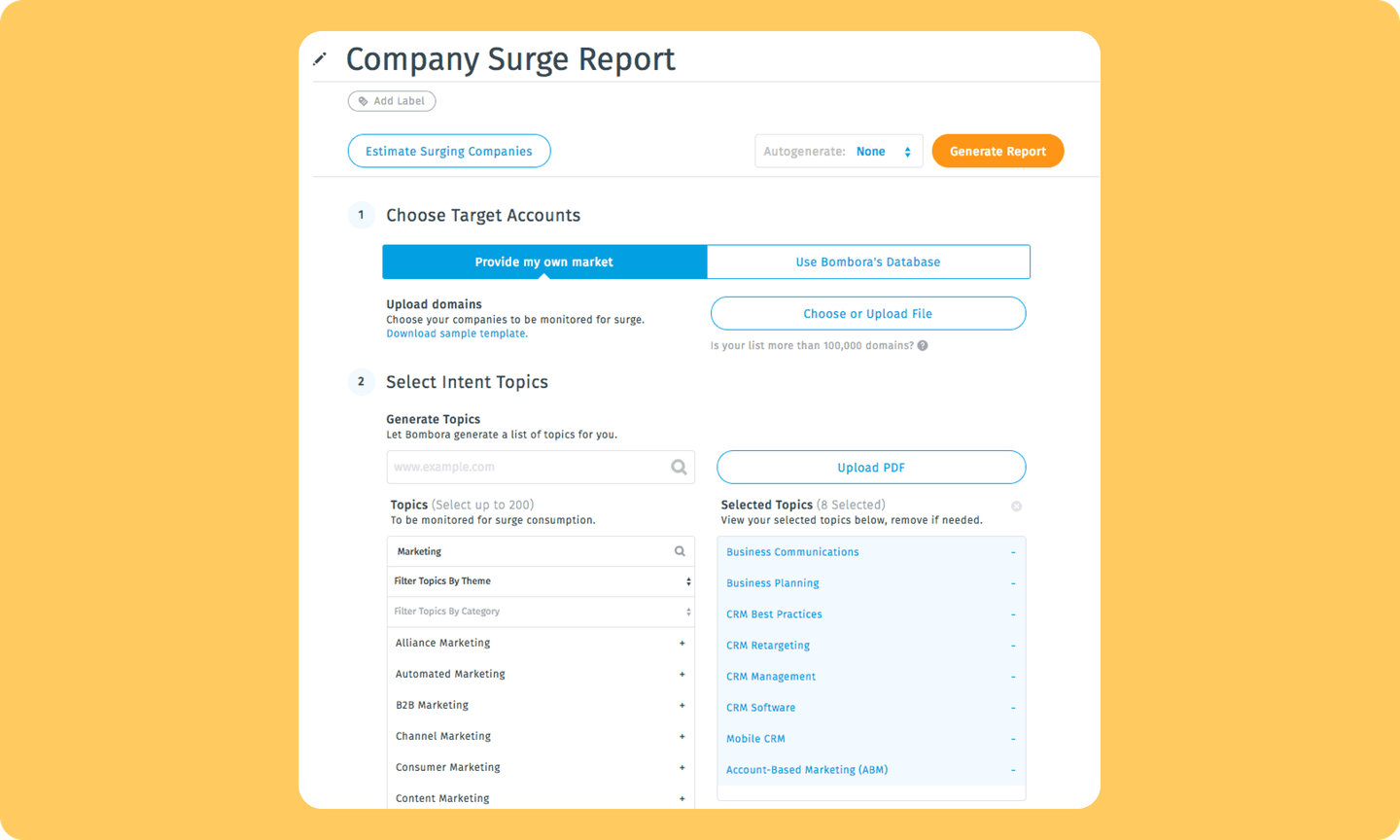

- Choose the target market: You can either provide your own target market by uploading a list of accounts, or you can create a list using Bombora’s database. With the latter, you’ll use search filters like industry, company size, revenue, and more to auto-generate a list.

- Define topic clusters: In Bombora, you can pick groups of related “intent topics” (e.g., “cybersecurity compliance,” “IAM solutions,” etc.) that match your industry. These clusters tell Bombora what kinds of research to track.

- Generate and review the weekly Surge report: You can set it up so that every week, you’ll get the latest Surge list imported into your CRM. This shows which accounts had research activity spikes above the baseline. You can sort by topic count (how many topics spike) and Surge score (intensity of research) to narrow down the accounts that are most likely to be in market.

- Drill into the details: For each high-priority account, your team can look at which topic clusters, competitors, or regions are driving the surge. Then, you can push these net-new or resurfaced accounts into the sales queue for BDRs to start outreach.

My favorite part of the tool is the automatic Surge report and net-new account to HubSpot. We come in each Monday with a new set of accounts actively shopping for our services and solutions.

What people like about Bombora

Here are some of the main reasons marketers like Bombora, according to actual users.

Shows companies that are “surging”

Bombora’s core intent metric—”Surge”—measures when a company’s interest in a topic spikes above its normal baseline. That surge score tells you which organizations have stepped up their research on your product category.

Setting up this report takes some time, and you’ll have to do the backend work of understanding who your target market is and knowing which topics indicate intent. But once this is done, Bombora will show you which companies are surging in intent.

You can identify companies that are surging enough in that search volume across the company… it quantifies who is actually in the market and buying mode for your product category.

For example, let’s say you sell telecommunications hardware to enterprises. In Bombora, you might see that a key account has started to increase its research into related topics in a specific location, like Boston. So, your team knows that the Boston office of this account may be interested in what you’re selling.

Integrates with popular CRMs

Bombora plugs into Salesforce, Hubspot, and other CRMs so that Surge scores and topic-level data appear on the account record.

This makes it easier for your team to see what’s happening with an account and take quick action.

AI-based insights for next steps

Bombora’s AI translates the topics that an account is researching and consuming into signals that show their buying journey stage. It will also show you which specific topics an account has researched so that you can tailor your outreach.

Even post-sale, Bombora will surface accounts that are in danger of churning based on their research history.

Where Bombora’s intent data falls short

Every tool in your kit has drawbacks, and Bombora is no exception. While this tool can help you prioritize accounts that are actively researching your industry, there are a few gaps that leave ABM teams wishing for more precision. Here’s where Bombora tends to stumble:

Contact-level insights are missing

You can use Bombora as a hammer drill and get big, overall insights. But, as one user stated, you won’t know anything about the contacts who may be in the market for your product. And other uses echo the same sentiment.

Without direct signals on the individuals researching your topics, ABM teams have to manually hunt down the right buyers.

Surge signals can be ambiguous

When you see a high Surge score, it doesn’t necessarily mean someone is ready to buy. You’ll still need to play detective to figure out why the surge happened, and which topics—or which decision-maker—triggered it.

Let’s go back to our telecommunications example above. You see that a target account has increased research on key topics in the Boston area.

But who is doing that research?

Is the reason for that research that they’re launching a new project and are in the market for what you sell?

What stage of the buying process are they actually in?

Bombora’s intent data won’t tell you any of this definitively.

Filtering options can feel too broad

Bombora’s topic clusters and Surge filters cover thousands of categories. But once you slice into a cluster, the lists can still be hundreds or even thousands of accounts long.

You can narrow by industry or intent intensity, but you can’t narrow to the handful of people who actually matter.

Coverage can vary by industry or region

If you sell to a niche market or smaller geographies, you may find fewer signals than you need.

The Bombora Data Co-op is vast, but it’s not infinite. Some industries or international segments simply don’t generate enough publisher data to deliver reliable Surge scores.

Where Influ2 can take you further

If your ICP isn’t well-defined, using Bombora to spot accounts showing interest in your category could be helpful. But since they can only show you account-level insights, it can only take you so far.

However, you can combine Bombora with Influ2 to take action on priority accounts at the contact level.

With Influ2, your team can take high-scoring accounts in Bombora and target the individual contacts from that account with relevant ad campaigns.

You’ll see how individual contacts engage with ads, and can get a much more precise view of who at a company is interested in your product or industry.

Here’s how it works:

- Push an account’s Surge scores from Bombora into your CRM: Once that’s done, the Surge score will be saved on the account record.

- Identify the buying group within Surging accounts: With a list of priority accounts from Bombora, you can use tools like LinkedIn Sales Navigator to identify the individuals who make up the buying group at those accounts. Then, add those people to your CRM.

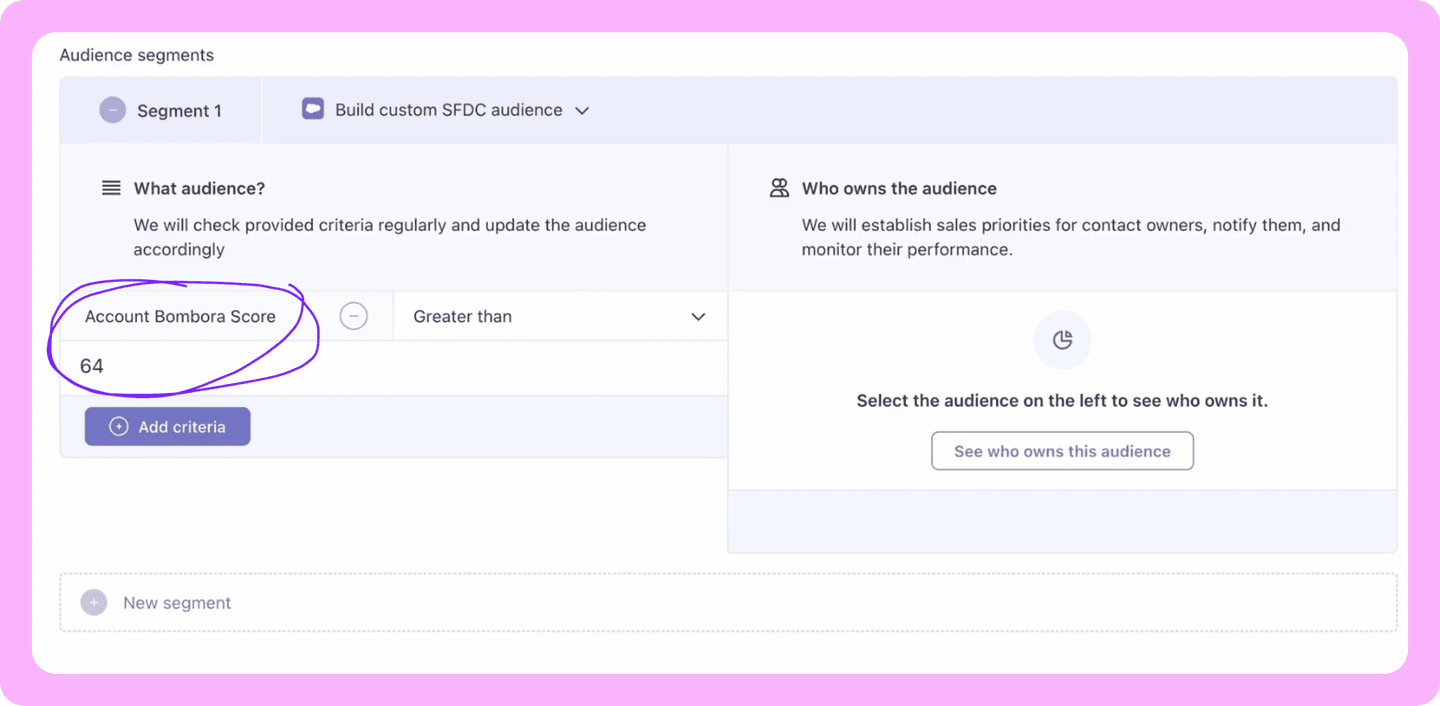

- In Influ2, create cohorts based on account Surge scores and individuals in your CRM: Since Influ2 connects directly with your CRM, Cohorts can be created using any data tracked there. Set up a filter for the account’s Bombora Surge score, and Influ2 will pull contacts from your CRM in those accounts with the score you set.

- Add other filters to narrow down your cohort: For example, if you want to add only people from certain industries or who haven’t been contacted by Sales yet, add those filters in now.

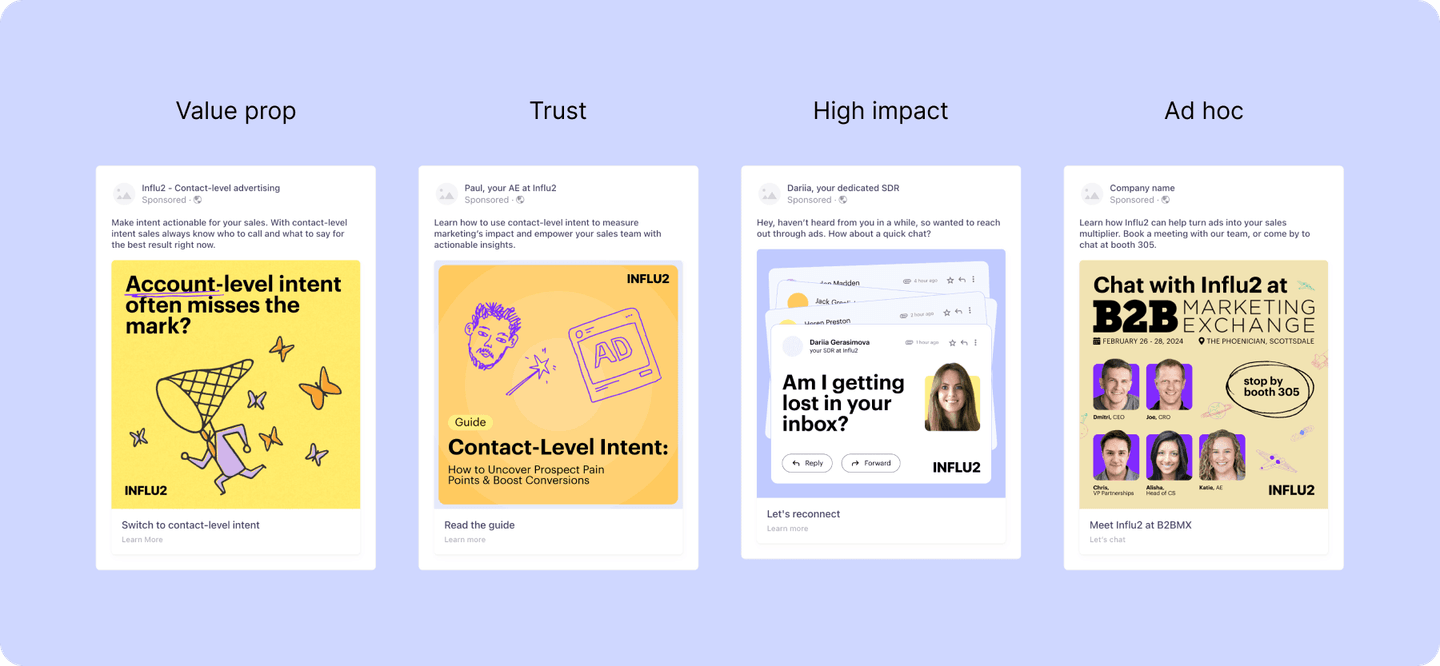

- Create ad campaigns specifically for this cohort: Now that you have a specific list of people from accounts that have been showing interest in your product or industry, you can show ads that are hyper-personalized to where they are in the buying journey.

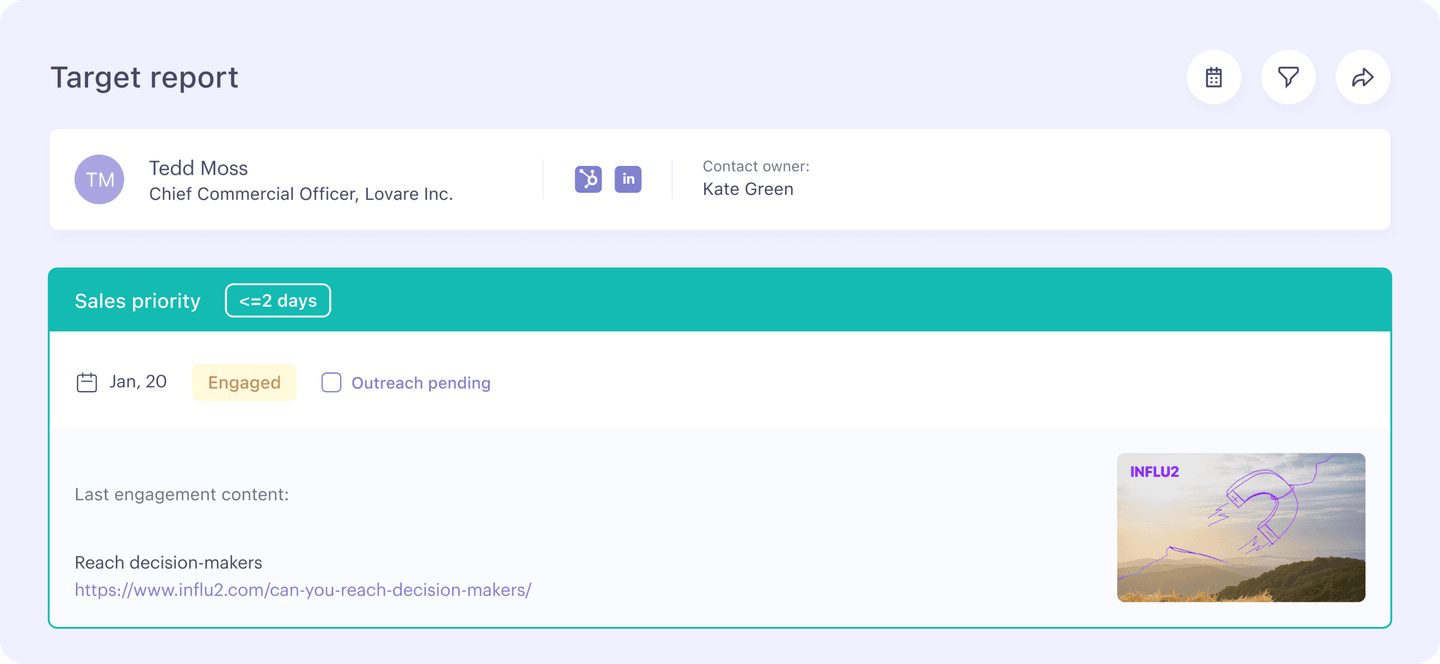

- Capture first-party intent signals: When those individuals click on your ad, Influ2 captures that signal. You instantly know who in the account is interested and what message resonated with them. (learn more about first-party intent data)

- Have Sales and Marketing run with that data: You can automatically notify your sales team when an individual engages with your ads. Now, Sales can follow up directly with the person and try to book a call, while Marketing can move them to the next step in the ad journey based on their stage in the sales cycle. Everyone’s working off the same, contact-level signals—no more guesswork.

By combining Bombora’s account-level intent data with Influ2’s contact-level intent, you get the best of both worlds: the right accounts on your radar, and the right people inside those accounts in your sights.

That means less random outreach, faster follow-up, and–most importantly—a pipeline that moves at the speed of real interest.

The difference between Bombora and Influ2 intent data

If you’re still wondering which tool fits better into your workflow, or if your team would benefit from the combination of both tools, then here’s a quick breakdown of the main differences:

| Criteria | Bombora | Influ2 |

| Account-level vs. contact-level signals | Surges show you which companies are researching relevant topics, but leave you guessing who is behind the interest. | Tracks intent signals at the contact level so you know exactly who's engaged, and can tailor your follow-up to them personally. |

| Reactive vs. proactive intent | Relies on passive web research—someone has to already be searching for you to see a surge. | Provides third-party intent signals from search, social, and off-site content, as well as lets you create intent yourself with targeted ads. |

| Third-party vs. first-party precision | Aggregates intent from B2B publishers, which can introduce noise or lag. | Generates intent signals straight from your own campaigns as well as gets signals from third-party websites, search, and social media. |

| Broad segmentation vs. hyper-focused cohorts | You build Surge lists by topic clusters, then push them into your sales process at volume. | You define your ABM audience based on contact lists from your CRM. |

| Manual follow-up vs. automated alerts | Teams pull Surge reports and then manually assign accounts to reps. | Can send notifications into Slack or your CRM the moment a named contact clicks an ad, so Sales can follow up quickly. |

Here’s the bottom line: Bombora gives you a high-altitude view of which companies might be in market, while Influ2 zooms in on the actual people making the decisions—and even helps you spark that interest in the first place.

Use them together, and you’ll know exactly which accounts to target, which buyers to prioritize, and what message to lead with every time.

Want to go beyond accounts?

Bombora can be useful for account information, but the reality is people make decisions, not accounts.

Influ2 is built for this reality and helps brands act on contact-level intent, reach named buyers with ads, and make their revenue impact clear.

Want to see how contact-level ABM can works? Book a demo with us.

Or check out our other intent data provider breakdowns:

Dominique Jackson is a Content Marketer Manager at Influ2. Over the past 10 years, he has worked with startups and enterprise B2B SaaS companies to boost pipeline and revenue through strategic content initiatives.