10 Intent Data Providers to Consider in 2025

It seems like every other day, a new intent data company pops up or announces a recent funding round, all of them claiming to offer unparalleled insight into what buyers care about.

The pitch looks good on paper, but it's often hard to tell whether what’s going on behind the scenes is as good as the product’s messaging.

To help you narrow down your options, we’ve taken a look at some of the most popular tools that offer intent data and pulled together a list of 10 to consider.

Also, keep in mind that most of the tools on this list aren't solely intent data providers. Many offer intent data in addition to their primary offering.

1. Influ2

Influ2 helps companies generate first-party intent data through contact-level advertising.

It gives you the ability to deliver relevant ads to named buyers at target accounts.

Here’s what makes us different:

Many of the intent data sources that revenue teams typically rely on (like most of the third-party providers later on in this list) give you mostly account-level intent data. They tell you, “Someone at Meta clicked on your ad.”

Influ2, by contrast, gives you contact-level intent signals.

We tell you, “This specific buying group member clicked on this specific ad.”

Each time they click an ad, it's a signal that reveals more about the challenges, pain points, and goals that connect with and motivate that buyer.

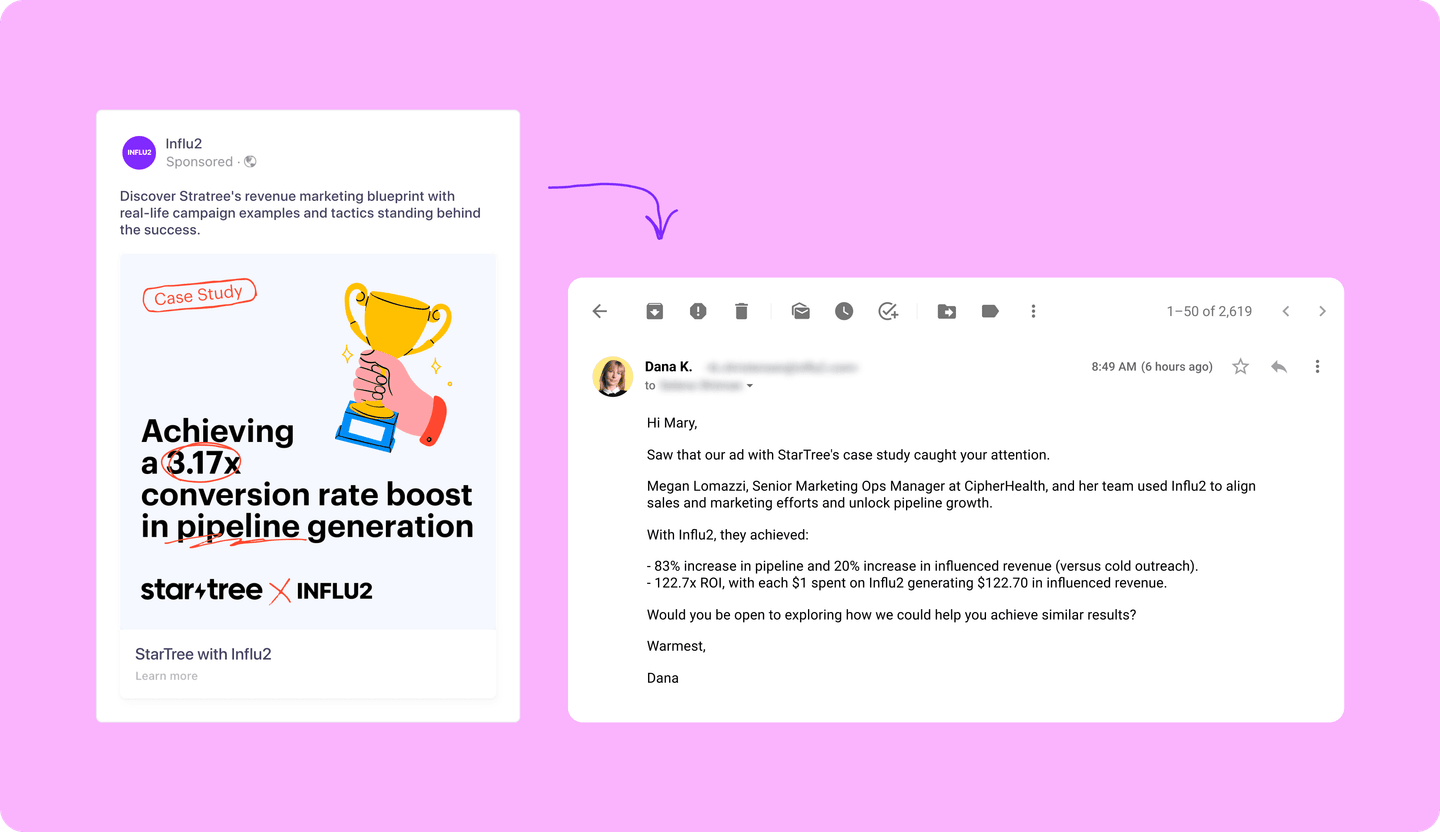

Marketing can use these signals to refine their programs and show more relevant content via ads, while Sales can dig into the Sales Priorities dashboard (or receive intel directly in Salesforce) to determine what to do next.

For instance, an SDR might use that contact-level intent data to make their email outreach more relevant to that prospect’s needs.

Types of intent signals

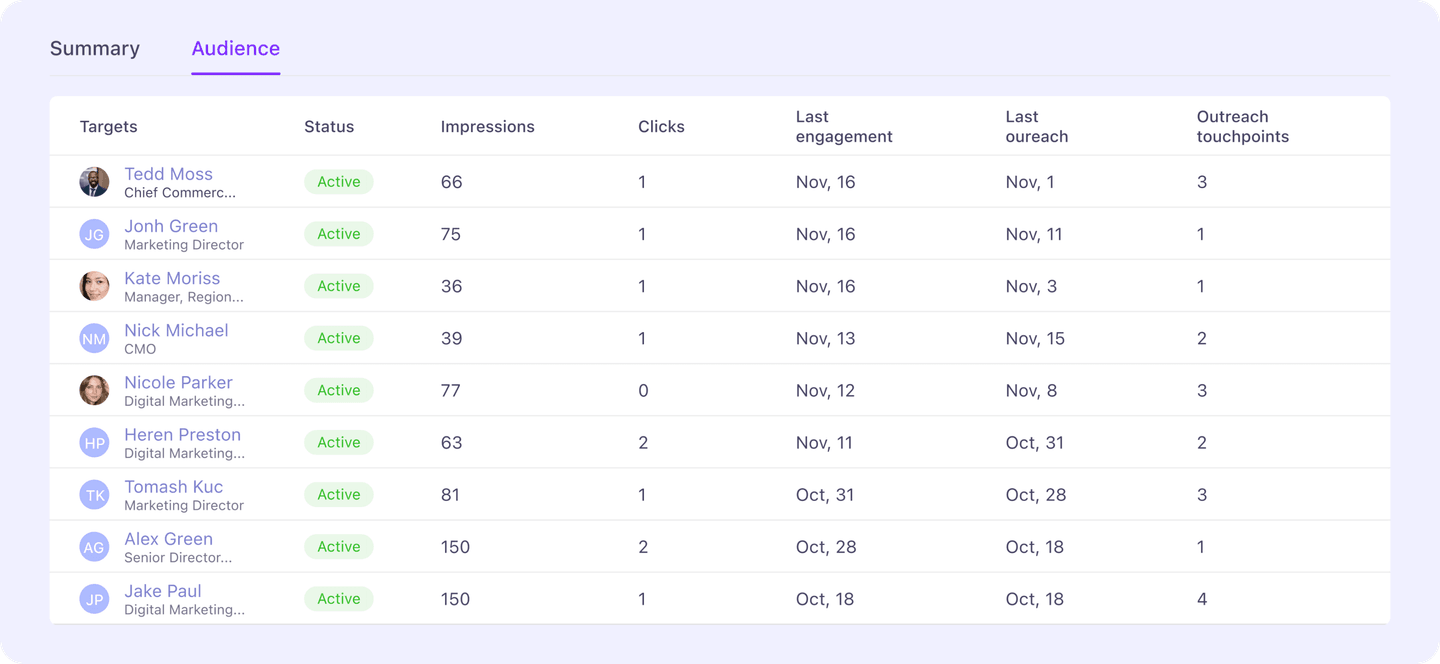

Influ2’s intent data is entirely based on ad engagement. You can see:

- Which prospects saw which ads

- How many times they saw a given ad

- Which ads they clicked

Where the data comes from

The intent data you receive from Influ2 comes from how your prospects engage with your ads.

Account-level or contact-level data

All of the intent data that comes from Influ2 is contact-level.

Integrations offered

- Salesforce

- HubSpot

- Marketo

- Outreach

- Pardot

- Oracle

- Act-On

2. Pendo

Pendo isn’t strictly an intent data provider.

It's more of a product analytics tool (though they call themselves a Software Experience Management platform), but it's a solid place to get first-party intent data on users who are trialing your product.

You can dig into how users are interacting with your product, such as which features they’re using most, to tailor sales conversations and personalize ad air cover.

Types of intent signals

- Feature usage

- Page views

- In-app guide interactions

- Survey responses

- User feedback submissions

Where the data comes from

First-party data collected directly from user behavior inside a company’s own product or app via the Pendo tracking layer.

Account-level or contact-level data

Pendo provides both account-level and contact-level data.

It can tell, for example, which features are being neglected by the entire organization, or how often a specific user logs in.

Integrations offered

- HubSpot

- Salesforce

- Marketo

- Pardot

- Segment

- Slack

- Gainsight

- Zendesk

- Amplitude

3. Snitcher

Snitcher is a website visitor identification platform. It can tell you who is on your website and how they are interacting with the content on it.

Types of intent signals

- Website visits

- Page views

- Session duration

- Navigation paths

- Content engagement

Where the data comes from

Snitcher’s data comes from how visitors interact with your own website, though they also provide some data enrichment via Clay, lemlist, and Unify.

Account-level or contact-level data

Snitcher’s intent data is primarily account-level.

While it can sometimes tell you the exact person who is browsing your site, more often the intel is along the lines of “Someone from Microsoft viewed your pricing page.”

Integrations offered

- HubSpot

- Smartlead

- Salesforce

- Apollo

- Pipedrive

- Lemlist

- Zoho CRM

- Segment

- FullStory

- Dreamdata

- Slack

4. G2 Buyer Intent

G2 itself is a software review platform, but it sells intent data through its sub-brand, G2 Buyer Intent.

This data gives you insight into what prospects at target accounts are doing on G2’s website.

For example, it can tell you if someone at an account checked out a side-by-side comparison of your product and two competitors, giving you an idea of who they have in their consideration set.

Types of intent signals

- Category views

- Product profile views

- Comparisons with competitors

- Engagement with alternative solutions

- Review reading behavior

Where the data comes from

All of the data comes from user activity on G2.com.

Account-level or contact-level data

G2 really only gives you account-level data. It can tell you that someone at a specific company researched your product, industry, or competitors, but it doesn’t tell you which individual person it was.

The exception here is that if someone fills in a form on your G2 page, then you’ll receive their contact details (depending on what the person provided and whether they opted in).

However, you’re not going to get a full contact-level rundown on that specific person’s browsing history on G2, so the intent aspect of G2’s data is still almost exclusively account-level.

Integrations offered

- Salesforce

- HubSpot

- Marketo

- Demandbase

- Slack

- Bombora

- Outreach

- Salesloft

- Metadata.io

- Pipedrive

- Chili Piper

- PathFactory

- Segment

5. Gartner Digital Markets

Gartner Digital Markets is Gartner’s response to G2 Buyer Intent, but instead of being limited to only one data source, you get intel from three sites:

- Capterra

- GetApp

- Software Advice

Types of intent signals

- Category views

- Product profile visits

- Competitor comparisons

- Demo and download requests

- Engagement with user reviews

Where the data comes from

Gartner Digital Markets sources its data from user activity across Capterra, GetApp, and Software Advice (all of which are owned by Gartner).

Account-level or contact-level data

Like G2, Gartner’s intent data is almost exclusively account-level. You can access contact-level data from inbound leads on their marketplaces (e.g., Capterra), but in terms of third-party intent data, its all account-level.

Integrations offered

- Salesforce

- LinkedIn Matched Audiences

- 6sense

6. 6sense

6sense packs a number of intent data sources into one.

Some of that data comes from its own software, like its website visitor deanonymization function. Most of it is integrated from external sources, processed with AI, and presented as predictive insights.

Types of intent signals

- Website engagement

- Technographic signals

- Competitor and category research

- Content engagement across the web

- Engagement with relevant ad content

- Keyword searches

- Industry publication activity

Where the data comes from

6sense integrates intent data from several primary sources:

- Bombora (content consumption across a B2B publisher network)

- G2 and Gartner (user activity and research signals)

- TechTarget (research behavior on tech-focused websites)

- PeerSpot (engagement from the IT buying community)

It also captures and uses first-party data like website visitor behavior and content engagement data.

Account-level or contact-level data

6sense’s intent data is account-level.

Contact-level engagement data is available, but limited to known contacts.

For instance, if a contact is already in your CRM or marketing automation platform and engages with your emails or ads, 6sense can capture that behavioral data, but it doesn't provide any third-party contact-level intent.

The problem here is that they use IP/Cookie data as the identification method, which means its not always particularly accurate.

Integrations offered

- Salesforce

- Marketo

- HubSpot

- Pardot

- Oracle Eloqua

- LinkedIn Ads

- Salesloft

- Meta

- Outreach

- Qualified

7. Demandbase

Demandbase is a GTM platform focused specifically on helping teams running account-based marketing and selling motions.

Types of intent signals

- Keyword searches

- Website visits

- Content consumption

- Competitor research

- Engagement with industry publications

Where the data comes from

Demandbase’s intent data comes from two places:

- Bombora (content engagement across a B2B co-op network)

- Demandbase’s own B2B data network (3M+ websites tracking keyword and content behavior)

It also provides first-party data from website engagement and content downloads, and integrates second-party review and comparison activity from G2 and TrustRadius.

Account-level or contact-level data

Like 6sense, Demandbase primarily offers account-level intent data.

Integrations offered

- Salesforce

- HubSpot

- Marketo

- Pardot

- Outreach

- Slack

- Qualified

- Salesloft

- Segment

8. ZoomInfo

ZoomInfo came up as one of the leading providers of B2B company and contact data. That’s still a core capability, but they’ve expanded since then (mostly through acquisition) into an all-in-one GTM tool.

The operational side of revenue activities (e.g., B2B advertising and automated sales outreach) is now ZoomInfo’s broader focus, and intent data is built in as part of the picture.

Types of intent signals

- Keyword searches

- Content consumption

- Website visits

- Sales trigger signals like leadership changes, funding announcements, and product launches

- Engagement with industry publications

- Review site interactions

- Technographic signals

Where the data comes from

ZoomInfo’s third-party data comes from two places:

- Bidstream data from online ad auctions (content consumption behavior)

- Data co-ops and publisher networks (300k+ domains)

They also capture first-party data (website visits, form submissions, content downloads) and integrate second-party view data from G2.

Account-level or contact-level data

ZoomInfo’s intent data is account-level.

They have contact-level data available through their B2B contact database, but it’s not intent data; it's contact data.

Integrations offered

- Salesforce

- HubSpot

- Marketo

- Pardot

- G2

- Outreach

- LinkedIn Sales Navigator

- Slack

- Google Ads

- Zoho CRM

- Facebook Ads

- Salesloft

9. Bombora

Bombora is a bit of a unique player in the intent data space in that they’re one of the only companies around that still just does data without stacking a workflow layer on top of that.

Their third-party intent data is considered best-in-class. It's why some of the providers on this list (e.g., Cognism, 6sense, and Demandbase) also integrate and resell Bombora’s intel.

Types of intent signals

Bombora gives you topic engagement data. It tells you about how people at target accounts consume content on B2B websites, what topics they’re researching, how frequently, and how recently.

Where the data comes from

Bombora’s intent data comes from a cooperative of over 5,000 B2B publisher websites that track research behavior and content engagement. It's analyzed using a proprietary AI algorithm and delivered via Bombora’s Company Surge product.

Account-level or contact-level data

Bombora’s third-party intent data is account level.

Integrations offered

- Salesforce

- HubSpot

- Marketo

- Adobe Experience Platform

- Pardot

- RollWorks

- Outreach

- Salesloft

- Slack

10. Cognism

Cognism is a sales intelligence platform with a big focus on Europe.

Its main offering is company and contact data (especially B2B email and mobile data in EMEA), but it offers intent as well.

Types of intent signals

- Website visits

- Topic engagement across B2B sites and content consumption patterns (Bombora data)

- Job changes (e.g., new decision-maker in role)

- Company news (e.g., funding, hiring)

- Tech stack changes

Where the data comes from

Cognism integrates its intent data from a variety of sources:

- Content consumption data comes from Bombora

- Funding data comes from monitoring investment and funding rounds

- Hiring and job change signals come from tracking job postings, team growth, role announcements, and LinkedIn updates

Account-level or contact-level data

While Cognism does have a B2B contact database (in fact, that’s its main product), the intent data it provides is primarily account level.

Integrations offered

- Salesforce

- HubSpot

- Outreach

- Salesloft

- Outreach

- Pipedrive

- Apollo

- Slack

- Lemlist

- Zoho CRM

Top 10 intent data providers: Comparison table

| Provider | Intent data type | Signal source | Level of data | Best for |

| Influ2 | First-party (Ad engagement) | Ad clicks, views, frequency | Contact-level | Generating contact-level intent data throughout the buying journey |

| Pendo | First-party (Product usage) | In-app behavior, feature usage, surveys | Contact- & account-level | Product-led growth, trial insights |

| Snitcher | First-party (Web visits) | Website activity, page views, session data | Primarily account-level | Real-time web visitor identification |

| G2 Buyer Intent | Second-party (Review site) | Product comparisons, profile views, review reads | Account-level | Competitor analysis, bottom-funnel intent |

| Gartner Digital Markets | Second-party (Review site) | Behavior on Capterra, GetApp, Software Advice | Account-level | SMB software buyers |

| 6sense | Third-party (Aggregated) | Bombora, G2, TechTarget, web engagement, CRM | Account-level (some CRM-linked contact-level) | Predictive ABM, sales activation |

| Demandbase | Third-party (Aggregated) | Bombora, web visits, content, review platforms | Primarily account-level | Enterprise ABM, multilingual targeting |

| ZoomInfo | Third-party (Aggregated) | Ad bidstream, co-ops, G2, CRM/web activity | Account-level (contact data separate) | Data enrichment, sales automation |

| Bombora | Third-party (Co-op data) | Content consumption | Account-level | Surge scoring, intent layering |

| Cognism | Third-party (Mixed) | Bombora, sales triggers, job changes, tech changes | Account-level (plus contact database) | EMEA-targeted outreach |

Dominique Jackson is a Content Marketer Manager at Influ2. Over the past 10 years, he has worked with startups and enterprise B2B SaaS companies to boost pipeline and revenue through strategic content initiatives.